- October 29, 2013

- Posted by: Trent Wagner

- Category: News

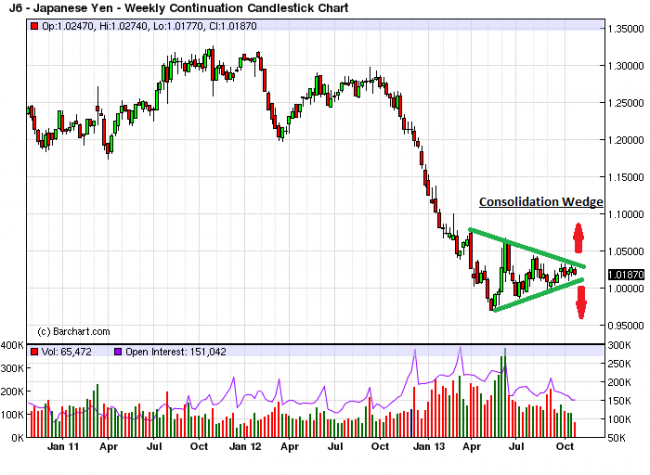

While technical patterns certainly do not tell the entire story with the price action in markets, there is a reason so many traders use technicals to help them analyze markets and help them to get a directional bias to the trade. It makes sense when you think about it, the price action in any market is the ultimate result of all information available at any particular time. There is a technical pattern in the Yen futures forming at this time that has our attention. Take a look at the weekly chart below:

As you can see, this market had a huge move to the downside starting late last year and eventually bottoming out in mid-May of this year. Since then, however, we’ve seen the market in a major consolidation phase – trading sideways in a range with the highs getting lower and the lows getting higher. Typically this formation is indicative of an impending breakout and, given the scope of the move prior to this pattern, we feel that there is opportunity for a big move in this market. However, deciding which way it will eventually break is difficult. In a vacuum, I would rather establish a short position here as the chart looks like this consolidation was healthy for this bear market as the Yen lost approximately 25% in a relatively short period of time. Once the consolidation runs its course, a continuation of the prior trend would be expected.

The problem with getting short here is that we are dealing with market conditions that are seemingly consumed by the monetary policy of the Fed. With the current meeting in progress as of this writing, it would be premature to get too directionally biased here as we have no clue what the Fed may announce at the conclusion of this meeting (please reference September’s post-meeting announcement). As such, I would prefer to play this potential breakout in a different way.

Because of the uncertainty with the direction of this market at the time, using a long strangle (or straddle, if you prefer) is a strategy that will allow a trader to take advantage of a big move in one direction or the other. Essentially, a call and a put are bought at the same time – with the thought process being that if we do get a sizeable move in one direction, the option that gains in value will outweigh the losses of the option that loses value as a result of that same move. It’s not a strategy that should be implemented all of the time, just when a large move is predicted as the directional move is going to have to be big enough to outweigh the fact that two options were bought at the inception of the position.

Questions or comments? Need help setting up the trade? Contact Trent directly at 312-756-0932 or a twagner@tradewithfox.com. For a free trial of Trent’s newsletter, The Weekly Options Trading Report, click on the link below and select “Options Newsletter” from the dropdown box in the subject line.

http://www.tradewithfox.com/contact/

*Past performance is not indicative of future performance. Trading futures and options involves substantial risk of loss and is not suitable for all investors.